Business Fraud Prevention

From Awareness to Action: FSCB Provides Your Business the Tools to Stay Safe. Protecting your business's privacy is important to us, and at First State Community Bank, we take measures to ensure your information is secure. We are dedicated to preventing unauthorized access to customer information and are committed to taking appropriate action to protect against fraud.

%20(1).png?width=659&height=327&name=Fraud%20prevention%20(1)%20(1).png)

Enhanced Security Features for You

Secure Transactions

Multi-factor authentication is required on any device that is not trusted or registered by the user. Additionally, step-up authentication is required when high-risk transactions are detected or processed.

ACH Payments

Allows your business to transfer funds electronically between banks, reducing the need for paper checks and minimizing the risk of fraud.

Wire Services

By using wire services, your business can ensure that transactions are processed in real-time, reducing the risk of fraud and unauthorized access.

Key Security Tips

Protect your business and your financial information from fraudsters and cybercriminals by following these safe banking tips.

Secure Your Devices: Update your computer, tablet or phone regularly, as well as any antivirus and firewall software. Use strong privacy settings on your devices to avoid pop-ups and unsafe websites.

Sign up for Banking Alerts: Protect your hard earned money by staying on top of your finances with FSCB alerts! Setting up account alerts can help you monitor activity and suspicious transactions. Don’t wait until it’s too late - Safeguard your accounts today.

Know How to Spot Phishing Attempts: Phishing is one of the most common ways cybercriminals attack. Don’t reply or click on any links in unsolicited or suspicious emails or texts.

Pick Strong & Unique Passwords: Pick a different password for each of your online accounts. Don’t use birthdays, anniversaries, pet’s names, children’s names, or common phrases like “password” or 12345. Use complex phrases at least 8 characters long, including upper and lower case letters, numbers and characters.

Multi-factor Identification: This is required for each digital banking user. It is the best way to prevent fraudsters from pretending to be you.

Learn What to Look For

Stay up to date on the latest scam tactics, by going to consumer.ftc.gov/scams.

Urgent and Threatening Language

Scammers may try to create panic by claiming your account is locked or compromised, pressuring you to act quickly. Be cautious with unexpected phone calls. To ensure your safety, call the number on the back of your bank card.

Asking for Credentials

Fraudsters may try to impersonate someone from your bank, and their caller ID might even show up as your bank. Banks never request your account number, PIN, or password via phone, text, or email — and will never ask for your secure access code.

Unexpected Emails and Text Messages

Avoid clicking on attachments/links in emails or text messages claiming to be from your bank. Fraudsters often send fake messages that look legitimate to steal your login credentials or personal details.

Set Up Account Security Alerts

Enroll in our digital banking platform to stay informed by setting up alerts and easily monitor your accounts via email, phone, or text messages.

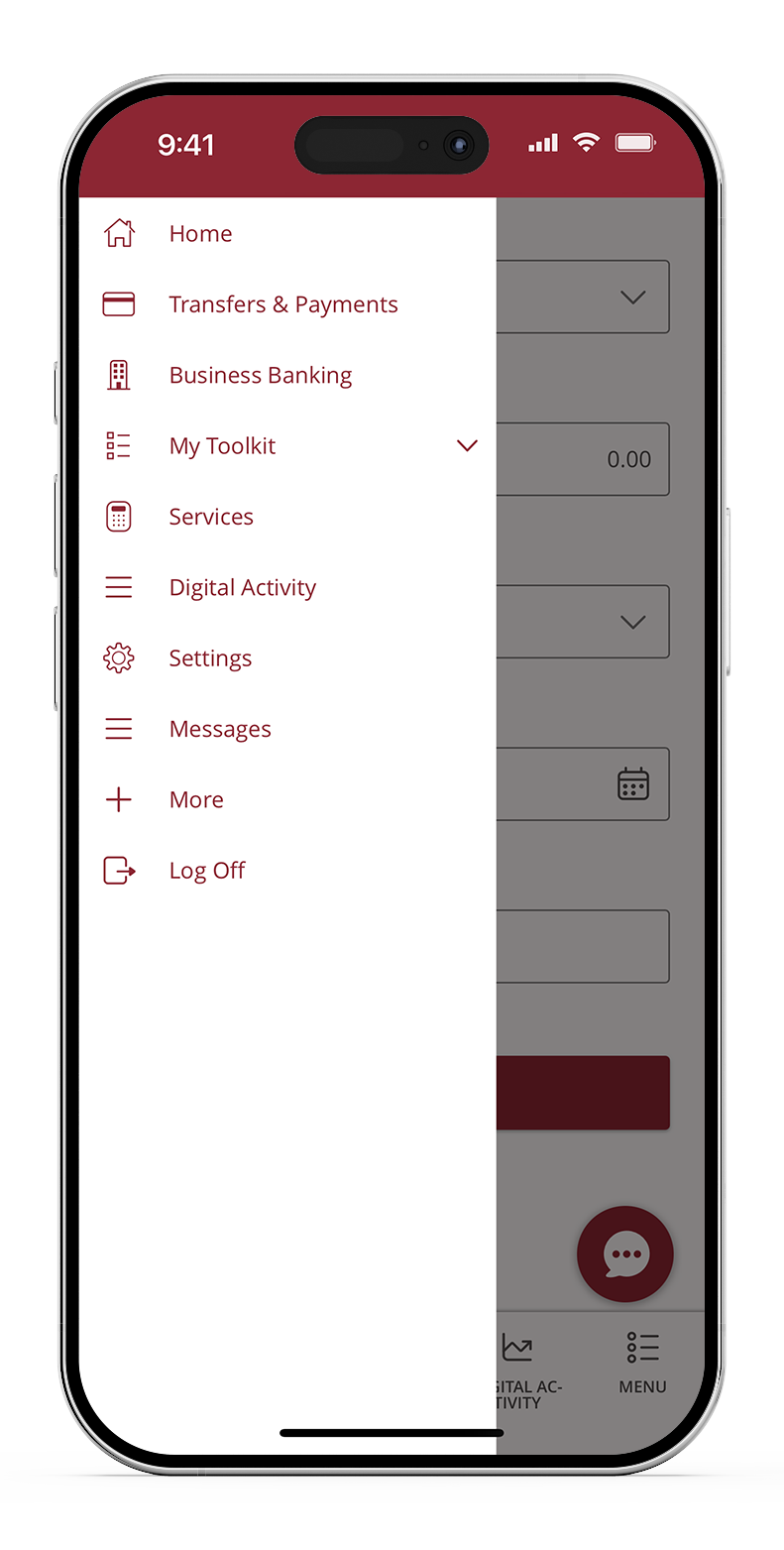

Step 1:

Under the menu tab, click settings.

How to Report Fraud

Monitor your accounts regularly. Here's what you should do if you notice unusual activity on your account.

Visit FTC.gov and report the scam.

Contact your bank by calling the number on the back of your card.

Call your local law enforcement to report the crime and obtain a police report.

If you have concerns about a phone call, text, or email from an unknown individual or company, be cautious and give the individual/company a call back to a known and verified phone number to ensure the legitimacy of the request.

Frequently Asked Questions

FSCB protects your business through tools like Positive Pay, ACH Credit Payments, and Wire Services—each designed to detect unauthorized activity, verify transactions, and safeguard sensitive data. These features add multiple layers of protection to ensure your funds are secure.

Businesses should regularly secure devices, set up banking alerts, and use multi-factor authentication for all digital banking activities. FSCB also encourages using strong passwords and learning to identify phishing attempts to prevent unauthorized access.

Monitor your accounts frequently for suspicious activity. If you notice unusual transactions, contact FSCB immediately using the verified number on the back of your bank card. Never share your account number, PIN, or secure access code with anyone claiming to be from your bank.