Take Your Bank with You: The Benefits of Mobile Banking

Smartphones have revolutionized every aspect of our lives, including banking. Banks have been working hard to keep pace with the digital age, developing new mobile apps designed to make it easier to manage your money. In fact, with the rise of online and mobile banking, some banks are offering accounts that do away with paper transactions altogether.

When we talk about mobile banking, we are referring to bank transactions that can be made from any handheld device, such as your smartphone or tablet. Mobile banking can be as simple as receiving text notifications from your bank or as sophisticated as using your smartphone to make deposits and pay bills. The growing popularity of mobile banking has mostly to do with convenience—you can bank from anywhere at any time—and it’s extremely valuable for routine activities, such as checking your account balance or sending money to friends and family.

How You Can Use Mobile Banking

Having access to your bank account from anywhere makes it easier to manage your personal finances in a number of ways. Below are some of the things you can do with a mobile banking app:

Deposit checks.

Mobile check deposit has reduced the number of lost checks. With mobile deposit, you simply take a picture of the check with your phone, and it is credited to your account.

Manage spending.

Many families don’t maintain a household budget, or if they do, they don’t watch their day-to-day spending. Being able to check your bank balance with your smartphone helps prevent overdrafts. If funds are running low, it’s also easy to transfer money from savings into checking to cover a transaction.

Pay bills.

Mobile bill pay also makes it easier to prevent late fees.There are many ways to use mobile banking apps, but according to the 2015 Mobile Survey as reported by the Federal Reserve, the most common reasons people use these apps are informational. Forty percent of people surveyed said they use mobile banking apps to check balances or transactions, 24 percent to receive alerts, and 15 percent to locate a local branch or ATM. At First State Community Bank, the most commonly used alerts are daily balance checks and transaction alerts, which also help with fraud detection.

Mobile banking has also led to more people using their smartphones for everyday transactions. The Mobile Survey found that 25 percent use their banking apps to transfer money, 20 percent pay bills via mobile banking, and 7 percent use apps to send money to family and friends.

Keeping Mobile Banking Secure

Advancements in biometrics are making mobile banking more secure. Facial recognition and fingerprint recognition are growing trends for secure logins and help make mobile banking safer and easier.

It’s risky to use public Wi-Fi networks, which can be easily hacked. If you are using a smartphone for mobile banking, you will have greater security using a private Wi-Fi network or a cellular connection than public Wi-Fi.

You Still Need Branch Banking

The ease and convenience of mobile banking has led to evolutions in the banking environment, such as “neo-banks,” which only offer remote banking services via the internet or mobile devices. However, the majority of bank customers—67 percent—still see the need to work with their local bank branches for loans, investments, financial planning, and other, more complex transactions. In fact, 25 percent said they would not open an account with a bank that does not have a local branch.

Most mobile apps are designed to supplement in-branch banking services, giving customers greater convenience and instant access to banking services they use regularly. Mobile banking is not a substitute for the personalized, friendly service you get at your local bank branch. Instead, consider mobile banking an extension of excellent customer service.

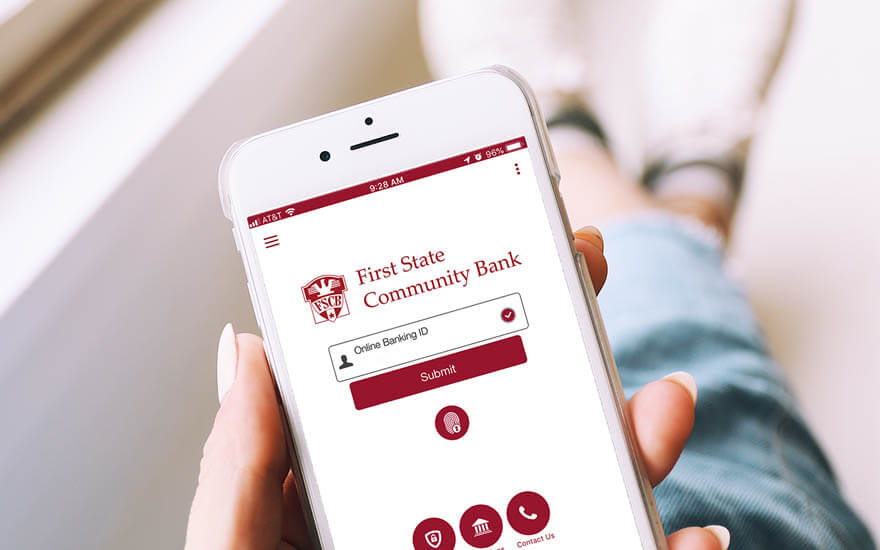

First State Community Bank has its own FSCB Mobile Banking App, offering a wide array of services designed to make banking easier and safer for customers. Regardless of whether you have an Apple or Android smartphone, check out our mobile banking solution in the App Store or Google Play.

.jpg)