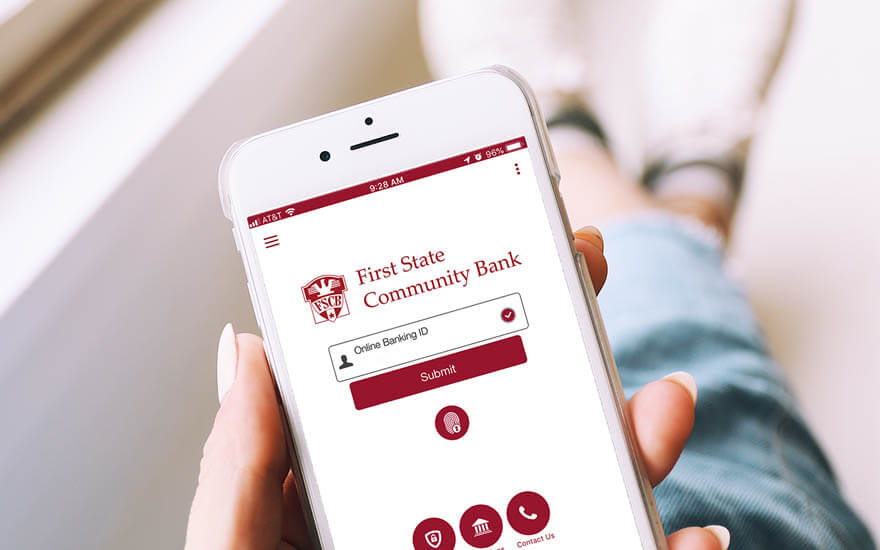

MOBILE BANKING

5 Ways Mobile Banking Apps Make Life Easier FSCB Blog

Banking apps give you control over your money, no matter where you are in the world. They’ve also become one of the most important apps on consumer smartphones. In fact, a 2018 survey found that mobile banking was one of the top three types of apps used by consumers.

From increased visibility into your finances to instant access to banking services, banking apps make life easier. Here are five things you can do with a banking app.

1. Check basic banking tasks off your list on the go

For customers who already use banking apps, it’s hard to imagine what life was like before basic bank services were available at their fingertips. If you’ve never used a digital banking app, you’re missing out on a number of features that can help you improve your money management while saving you a trip to a local branch.

With a mobile banking app, you can check your account balances, access statements, track spending, make mobile deposits by taking pictures of checks, and even communicate directly with your bank. This can all be taken care of within a few minutes, making it easy to keep close tabs on your money and manage your account wisely.

2. You can quickly find a nearby ATM

Looking for the closest ATM to withdraw some cash? Many mobile banking apps now offer an ATM locator tool that uses your mobile device’s location-based services to help you track down the closest ATM.

This feature can help you avoid fees charged by ATMs from other banks and credit unions—fees that you might be forced to pay if you don’t know your own bank offers a nearby ATM of its own.

3. Categorize spending to help you stay on budget

Some mobile banking apps offer budgeting tools to help you categorize and track your spending. Using such a tool is a great way to build better budgeting habits by being more aware of your spending.

You can also adjust your spending limits by category as you get a better sense of your spending habits and want to adjust your budgeting goals.

4. Manage bill payments and transfers from your phone

If you regularly use bill pay services offered by your bank, a mobile banking app can help you add, remove, or edit these scheduled payments with ease. Similarly, you can initiate transfers from your phone without going to a local branch. This can be very valuable if you need to make transfers quickly to cover new charges.

Mobile banking apps are also expanding their access to person-to-person payment services, which allow you to send money to friends, family, and coworkers. This is similar to what services like PayPal and Venmo offer, but these payments are seamlessly handled within your mobile banking app.

5. Receive alerts for various banking activities

Worried about a surprise debit charge bringing your bank account to a negative balance? What about fraud alerts for suspicious activity on your accounts? If you don’t check your bank account regularly, unauthorized charges and withdrawals could pile up while you’re none the wiser.

Your mobile banking app, however, can send you alerts for certain activities that you want to pay close attention to. You can customize these notifications so that you only receive the kinds of alerts you care about.

Even if you don’t consider yourself a tech-savvy individual, digital banking apps are easy to use and offer simple navigation to help you find the features and tools you’re looking for. If you would like help setting up your banking app, your local branch associates would be glad to help you install it so you can start taking advantage of its many benefits!

Learn more about FSCB mobile banking by checking out our mobile banking infographic.

.jpg)