Card Lock & Card Controls

Temporarily deactivate and reactivate your card through our digital banking tools to protect your funds from unauthorized use if it's lost or stolen. Set up alerts to track card activity.

Protecting your privacy is important to us, and at First State Community Bank, we take measures to ensure your information is secure. We are dedicated to preventing unauthorized access to customer information and are committed to taking appropriate action to protect against fraud.

Temporarily deactivate and reactivate your card through our digital banking tools to protect your funds from unauthorized use if it's lost or stolen. Set up alerts to track card activity.

Get FREE Access to your Credit Score to understand your current position and proactively spot potential trouble.

Link External Accounts to see your full financial picture and keep track of your transaction history.

Set up alert options for Account Alerts, Digital Activity, History Alerts, and Reminder to stay on top of your accounts and what's important.

Protect yourself and your financial information from fraudsters and cybercriminals by following these safe banking tips.

FSCB has partnered with Mastercard® to provide ID Theft Protection on qualifying accounts as an added layer of security.

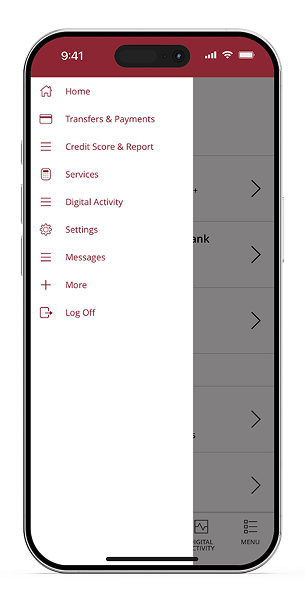

Enroll in our digital banking platform to stay informed by setting up alerts and easily monitor your accounts via email, phone, or text messages.

Notice unusual activity on your account?

FSCB provides several tools including Card Lock & Controls, Credit Score Monitoring, and Money Management to safeguard your finances. You can monitor your credit score, track transactions, and deactivate your card instantly if it’s lost or stolen.

Through FSCB’s partnership with Mastercard®, qualifying accounts receive ID Theft Protection to monitor and alert you of potential identity theft. This program adds another layer of security by helping detect suspicious activity early and guiding you through recovery steps if needed.

Set up account alerts through digital banking to track transactions in real time, use strong passwords, and enable multi-factor authentication for added protection. FSCB also recommends reviewing your credit score regularly and reporting any unusual activity immediately.