MOBILE BANKING

Online Banking vs. Mobile Banking

June 27, 2023

.jpg?width=2121&height=1413&name=GettyImages-1158243057%20(1).jpg)

A recent survey found that 76 percent of adults use their bank’s mobile app to access checking or savings accounts, monitor their current balances, and make digital deposits. This growing reliance on digital banking isn’t slowing down—another survey found that 90 percent of respondents plan to continue using technology to access their financial data.

Gen Zers and millennials account for a large percentage of digital banking customers, but senior Americans are also turning to the convenience of technology, with nearly 80 percent of Americans over 60 embracing online banking. The 2020 COVID-19 pandemic also increased online and mobile banking usage as lockdown and travel restrictions pushed millions of Americans to stay home. Mobile banking and online banking are both digital forms of banking meant to offer convenience and security, but they are not interchangeable concepts.

What’s the Difference Between Mobile and Online Banking?

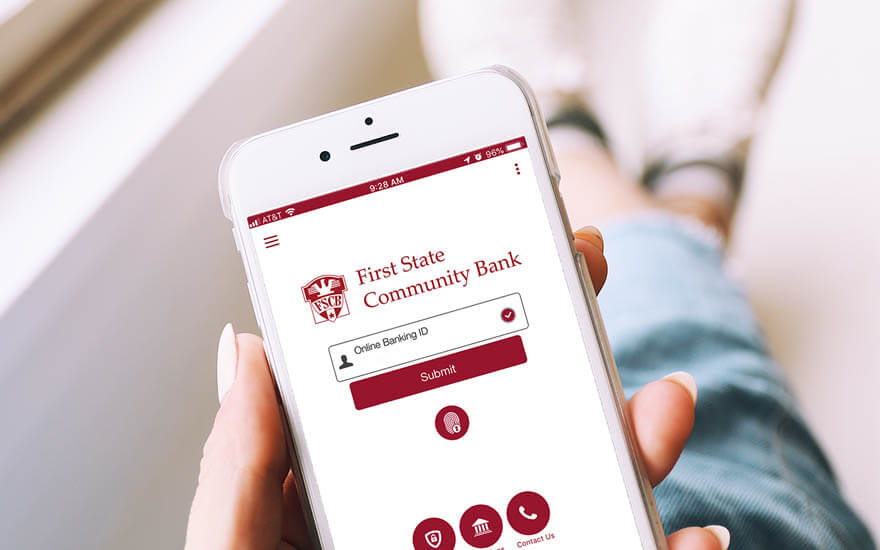

The primary difference between mobile banking and online banking is how users access their accounts. Mobile banking is performed on an app using a portable device, such as a smartphone or tablet. Online banking can be carried out on any device with an internet connection (e.g., desktop or laptop computer, smartphone, tablet) and doesn’t require users to download an app. Both options require customers to hold active bank accounts and register by creating a username and secure password.

The preference for mobile banking over online banking is on the rise. In 2015, about 37 percent of banking customers used online banking to carry out financial transactions, and only 10 percent used mobile banking. Now, most digital banking customers prefer mobile banking for on-the-go convenience. A financial institution’s website may offer a variety of functions, but apps often provide a seamless user experience and options not available on a website, such as the ability to deposit a check quickly.

Learn about the benefits of each type of checking account at FSCB and which one is right for you.

Download the Guide

Here are some of the features that can be found in mobile and online banking:

Mobile Banking

- Requires downloading an app

- Offers improved user experience and functionality

- Can be used to pay bills, make internal and external transfers, activate, cancel or lock your debit card, find ATM locations, deposit checks, and contact customer service specialists

- Can send push notifications if an account balance is low or overdrawn or any fraudulent activity is suspected

- Can be connected to budgeting apps or other money management tools that can monitor all financial activities

- Offers more security than online banking, according to some cybersecurity experts

Online Banking

- Doesn’t require the download of an app

- Gives users a more in-depth view of their bank accounts along with easy usability

- Provides consumers with the ability to open new accounts quickly and seamlessly

- Allows registered users to view their account balances, download statements, and apply for loans and banking cards

- Cannot be accessed without a reliable internet connection

- May be associated with brick-and-mortar locations or operate online only

Track your spending habits and take control of you finances with our Download the Guide

Security Tips for Online and Mobile Banking

Any financial transaction performed online carries some risk—in 2020, the total cost of cyberattacks in the financial industry hit a staggering $18.3 million a year per company. Here are a few simple ways to protect your online and mobile banking accounts:

Mobile Banking

- Make sure to download the verified app provided by your bank.

- Enable two-factor or multi-factor authentication.

- Use passwords that are at least eight characters and contain a combination of letters, numbers, and symbols.

- Avoid public Wi-Fi networks.

- Make sure that your mobile device is updated with the latest operating system.

- Sign up for push notifications or text messages if any fraudulent activity is suspected.

Online Banking

- Make sure that all devices you’re using are updated.

- Sign up for banking alerts via email or text that will notify you of any suspicious activity.

- Don’t log in to your online bank account using public computers.

- Use strong passwords that contain a combination of letters, numbers, and special characters. Change them regularly.

Both online and mobile banking offer customers convenience and speed, along with the ability to monitor their accounts and financial progress. Learn how to incorporate digital banking into your plan for the future and keep your money on track by downloading our guide Financial Planning During Uncertain Times.

Find your perfect checking account with our free guide.

Download the Guide

.jpg)