202

Completed Community Projects

Get personalized service from local banking experts, secure 24/7 digital banking access, and make everyday banking simple, safe, and close to home.

Decades of growth, generations of trust - our values are still the heart of who we are. We've proudly served our local customers since 1954, and we're committed to continuing that legacy for years to come.

We're not just here to serve the community, we're proud to be a part of it. Supporting local families, businesses, and causes has always been a part of who we are and we're committed to making a positive impact wherever we can. We actively participate in the events, efforts, and everyday moments that make our communities thrive, and to us, that truly matters.

Completed Community Projects

In Donations to our Community

Hours Served in our Community

We believe in building stronger communities. With over 200 projects, $875,000 in donations and 17,000+ hours of service, we are proud of the impact we make in our communities every day.

Perryville team members lead a fun, hands-on financial literacy game with employees at United Enterprises, a nonprofit that provides meaningful employment to individuals with disabilities. The team taught smart money habits in an inclusive, empowering environment.

Rolla team members brought new life to Phelps County Industrial Solutions by painting walls, installing lockers, and refreshing breakrooms, creating a brighter, more welcoming space for the individuals they serve.

Jeffco team members partnered with Hammers of Hope to build a deck from scratch for a family in need, creating a safe, welcoming space for a household that lacked the resources to build one on their own.

The Sullivan and Gerald teams came together to collect a powerful wave of donations—making a meaningful impact for a local organization and the people it serves.

The Washington team presented a check donation to YourOtherMother, a local organization that provides essential items to families preparing for a new child. Their contribution included 12 cribs and 12 mattresses, helping ensure babies have a safe place to sleep and families have access to diapers, clothing, and other necessities.

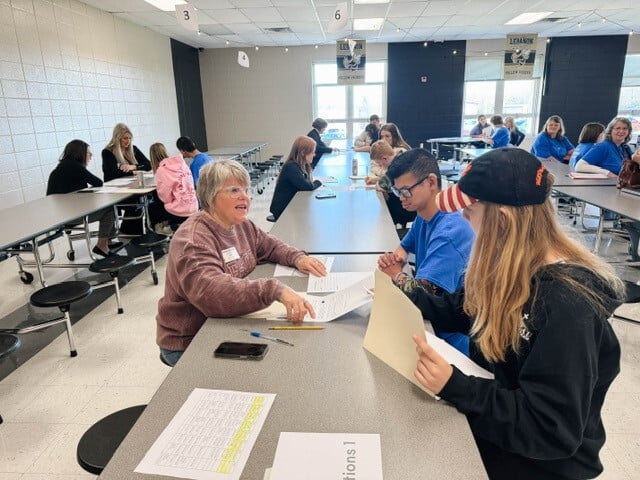

Lebanon team members joined students at Lebanon High School for the Job Olympics, guiding underprivileged youth through interactive activities that teach real-world decision-making, career skills, and the impact of everyday choices. A day of fun, learning, and empowerment.

Every journey begins with a first step. Let us help you take yours.

Bank from anywhere with FSCB's digital banking tools Say hello to seamless transactions, intuitive interfaces, and unparalleled convenience, for your personal or business use, all at your fingertips.

You are about to leave First State Community Bank’s website. FSCB is not responsible for the content or privacy practices of external sites.