Chapter 2

Paying the Taxes You Owe: The 5 Pillars of Tax Planning

If you aren’t taking time to plan your taxes and maximize your deductions, you’re probably paying more taxes than your fair share. Tax planning isn’t a process of cutting corners and cheating the government. Instead, it is an opportunity for hard-working taxpayers to claim every deduction, credit, and tax advantage the government is providing to them.

To maximize these tax benefits, you’ll want to follow the “5 Pillars of Tax Planning.” These pillars are as follows:

Deducting

Have you claimed all popular deductions available to you? Although most consumers are best served by taking the standard deduction offered by the IRS, some taxpayers can reduce their tax obligations by itemizing these deductions.

Common deductions can include the following:

- Medical expenses

- Tuition costs

- Charitable giving

- Mortgage insurance

- Property taxes

- Contributions to HSAs, Dependent Care FSAs, and other tax-free funds

Deferring

Deferring taxes can be a great way to incentivize investing and to delay payment of taxes until a time in the future when you’re more likely to pay a lower tax rate. This strategy is common for contributions to 401(k)s and other retirement accounts (other than Roth accounts, which are not tax-deferred), and it can reduce your present-day taxation by putting away money to fund your retirement.

Related: Tax Planning: When Are Taxes Due

Dividing

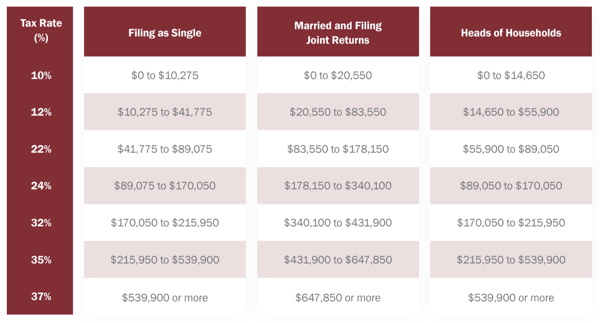

In cases in which family members are filing taxes separately, the process of dividing income can distribute income to taxpayers who will be taxed at a lower rate, resulting in overall tax reductions for the family as a whole.

Disguising

Certain types of income can be accounted for in different ways to reduce your overall tax burden. For example, capital gains from a taxable investment can be deposited into a tax-deferred retirement account, thereby reducing your overall taxable income. Because taxable gains are often taxed at a lower rate than earned income, you can use this transaction to move income out of your highest tax brackets.

Dodging

The name of this pillar may sound sketchy, but the process of dodging is really as simple as moving money from taxable to non-taxable accounts. You might do this through retirement account rollovers, property investments, or other strategies that shelter your money from taxation.

In addition to these five pillars, keep an eye out for applicable tax credits that can cut down on your taxes owed. Tax credits may be issued for education costs, electric vehicle purchases, or a wide range of other government initiatives.

These credits can change from year to year, so do your research to see which ones may benefit you in the current tax year. A single tax credit can cut hundreds or even thousands off of your tax bill, which can make a big difference to your checking account.